Come and Join me on Flipboard for regular news and articles on Gold & Silver investing. Prepare for the coming currency crisis and don't be left with your pants down. Click the link below.

Friday, February 21, 2014

Sunday, April 21, 2013

Part 3: Aussie Housing Bubble: The Pain of our Delusions will be borne by our youth.

Philip Soos explains that there are three phases to finance:

What about once he gets into his office? TRANSFORMATION. For all those Star Wars nerds you'll understand the quotes referenced.

"hedge, speculative and Ponzi. With hedge financing,

income flows from an asset are sufficient to pay down both principal and

interest on the debt used to finance the asset purchase, and prices are based

upon intrinsic value. Speculative financing results in income flows covering

only interest repayments, not principal, requiring debt to be continually

rolled over. Investors may experience financial stress, but it is not

widespread and fundamentals valuations are kept largely in check."

"with Ponzi finance, as income flows cover neither

principal nor interest repayments (including running expenses in the case of

rental property). Investors rely solely on escalating capital values in

order to realise substantial capital gains at sale to pay down the cost of debt

and balance their income losses. Asset prices are completely delinked from

fundamental valuations at this stage. Investors rely upon ‘greater fools’ to

maintain positive price momentum, resulting in a bubble. Once there are no more

investors willing to take upon staggering amounts of debt to finance asset

purchases, prices stagnate then collapse, as the market finally realises that

prices are based upon a pyramid scheme, not fundamentals,"

So after reading my last two blog posts, you might be

worried that in fact Australia is in a price bubble. Well with all the charts

we have seen, have a look at this one.

How can anyone is their right mind think that house prices

in Australia are based on real market fundamentals when the correlation of

household debt to GDP ratio chart is exactly the same as the real housing price

chart. I have overlayed these in photoshop for you to see.

There is not much more evidence you need to see that house prices are

not connected to housing fundamentals of supply and demand, but they are

instead connected to lending fundamentals of debt and borrowing. The more we

are allowed to borrow, the higher the prices will go up. It is absolutely insane, and you should be angry.

Soos goes on to say:

"Another indicator is the rising levels of household

debt used to speculate on housing prices. Household debt is overwhelmingly

composed of mortgage debt, whereas personal debt is a small fraction. Figure

shows the recent and considerable increase in the household debt to GDP ratio,

peaking at 97 per cent in 2010 when housing prices did the same. The ratio has

fallen slightly to 93 per cent, which may explain the falls in property values

over the last two years, including the historically-low growth in housing

finance data (Housing finance misses expectations in November, January

14)."

"A troubling fact is that almost 60% of investor loans

are interest-only (25% for owner-occupier loans), signifying the speculative

motive of property owners,"

"Investors were then dependent upon rising capital

values in order to realise a profit at sale and to cover the cost of mortgage

debt... This resembles the terminal Ponzi phase, where housing prices and the

household debt to GDP ratio have boomed while net income losses have

escalated."

"Accordingly, by these measures, the evidence suggests

that the residential property market is currently experiencing a bubble, with

prices detached from fundamental valuations... This appears to be the largest

bubble on record, orders of magnitude larger than all preceding bubbles... When

it does burst, heavily indebted property owners (recent home-buyers, negative

gearers) will experience financial trouble, including the economy at

large."

Professor Steven Keen recently commented on Today Tonight that what may cause the Housing Bubble to continue are "pollution refugees" who are wealthy Chinese investors that can compete in the Aussie market for new homes. This even playing field between the domestic and international players is one that is unique to Australia. In my opinion this is a slap in the face to the Australian public, not to mention a sloppy short-sighted way of boosting the housing market.

So do you have a mortgage? Remember that in bubble phase psychology, as the price escalates exponentially you go from euphoria to delusion. As the prices flattens out you go from delusion to denial. Following this we go from denial to fear as the media discovers the bubble is popping, and shortly after we go from fear to price capitulation. However I beleive the Government is willing to dish out more pain and suffering to those who have hopes of ever affording a home.

So do you have a mortgage? Remember that in bubble phase psychology, as the price escalates exponentially you go from euphoria to delusion. As the prices flattens out you go from delusion to denial. Following this we go from denial to fear as the media discovers the bubble is popping, and shortly after we go from fear to price capitulation. However I beleive the Government is willing to dish out more pain and suffering to those who have hopes of ever affording a home.

So who can we blame for this mess? Obviously as I have

covered the main people to blame is the Federal Government through stimulus measures

such as FHOS (or as Steve Keen calls the First Home Vendors Scheme) and providing policy to help leverage debt.

However for cathartic kicks and giggle I want to personally attack the seedy underbelly of this Housing Bubble which is none other than the fat belly of mortgage lenders. Other than the banks this big belly has the big face of Aussie Home Loans, head up by Fat Cat John Symonds. So I have prepared some photoshopping to better help understand exactly how disgusting the people whom we decide to enslave our families to. (Note: all images are photoshopped and manipulated.)

However for cathartic kicks and giggle I want to personally attack the seedy underbelly of this Housing Bubble which is none other than the fat belly of mortgage lenders. Other than the banks this big belly has the big face of Aussie Home Loans, head up by Fat Cat John Symonds. So I have prepared some photoshopping to better help understand exactly how disgusting the people whom we decide to enslave our families to. (Note: all images are photoshopped and manipulated.)

Here;s your daily John Symonds inspiration for the day!

Saturday, April 13, 2013

Part 2: Australian Housing Bubble: 3 Myths Debunked.

Myth 1: Australian housing is a great investment. FALSE.

This chart shows the Actual Real Rental Income on properties that are rented out by investors.

Since the expansion of easy credit has allowed for higher rates of speculation for investment returns on total house price, investors for the past 10 years have been willing to take on a Real Rental Income loss on their properties. This is amazing because it defies all rational logic for an investment. It means that investors truly believe housing prices will go up no matter what. This means that rental returns are no longer a driving force behind property investment, and total asset price-appreciation is the over-riding driver. They say that rent money is dead-money, but I would argue that housing investment money is foolish money, and renter money is patient money. It is cheaper to rent than it is too buy and the next point explain this further.

Myth 2: It's better to Buy than it is to Rent in the long-run. FALSE.

Not in this economy. Maybe 10 or 20 years ago, but im sorry generation X and Y but your baby boomer elders have sold you out. They lived on easy money and rode the debt train all the way to the end of their lives, and guess what ... they left you to pay for it all. How can we get revenge on them? EASY. Do NOT buy their overpriced houses. This will cause house prices to fall and leave them with negative equity, this means that Gen Y and Gen X wont have to pay someone else's bill's, and it means that we get our revenge at the last minute. Do you really want to buy still anyway? Well take a look at this chart below...

Sorry I don't have the figures for 2012 but I assure you nothing has changed. Now notice what happened in 2007-8. There was downward pressure on dwelling price-income rations, and we all know that this was the US housing Bubble popping and the GFC. US home-owners were stretched to their limits at a ratio of 2.7 before it collapsed. Australians are willing to live in the 4 to 5 ratio ... Do you know anyone who despite low interest rates still struggles to pay of their mortgage? Notice how the ratio for Australia dips below 4 towards a correction and then spikes back up. That's the effect of the First Home Owner Scheme, the Government stimulus designed to avoid the housing market correcting itself. The Government decided to kick the can down the road on a housing market collapse. This has only delayed the bubble bursting by fooling more and more investors into the market with their hard eared savings on house prices they cannot afford. This 4-5 ratio is of concern to the RBA who is keeping interest rates low, but unless incomes rise substantially it is not financially sustainable for Australians to be affording the cost of home-loans. Even at our historically low interest rates it is still increasingly expensive for people to enter the market. Cracks are already appearing in the housing market with fewer people taking up the FHOS grants.

Myth 3: Housing is in high demand because of high population growth, and this supports future price growth. FALSE.

In Australia the annual dwelling starts index has always followed the annual population growth index. But there emerged in 2009 a massive disconnect as people started to swallow the red pill of reality. But the Government scrambled to produce blue pills of fantasy called FHOS (first home owner scheme grants). This brought the ratios back in line over 2011, but as you can see in 2012 this was drifting away again and now in 2013 it is drifting even further, and people are not taking the blue pill anymore.

But you might be thinking that this doesn't make sense. How can more people not equate to more dwellings? Why can't I fix my computer with only just a hammer? Well the other week I went looking at the rental and share accommodation market in suburban inner-west Sydney. Through 10 different places I saw people renting our their living rooms, normal apartments converted to dormitories, and parents sharing rooms with their children whilst trying to rent out their only other spare room to strangers.

Its SIMPLE, people increasingly cannot afford to buy or own homes at these prices. Supply and demand only works when prices are affordable. You can raise the population all you want, but with real wages not rising in accordance with real prices you get jammed. The FHOS grants are not helping people, but rather inflating house prices and acting in a similar way that teaser rates were used in the sub-prime mortgage market in the USA. People need a dwelling they can afford and debt they can manage, and this means a new trend will be people choosing to share homes. People need to survive, and the government can only distort the marketplace for so long before the illusion no longer works.

Saturday, April 6, 2013

Part 1: Australian Housing Bubble Visualized

"A bubble doesn’t occur because investors become fools, it

occurs because fools become investors."

- - Tom Woods 2013

This statement reflects the dangers of speculation in any

marketplace. When Governments start stimulus programmes that encourage

speculation, this becomes a direct intervention on the free market. Such an

intervention is commonly seen as manipulation. Governments will do this

to encourage economic activity through asset purchasing and debt accumulation. Australia

is politically a see-saw and the Australian people are willing to jump between left and right in back to back elections. This means that

politicians will focus on short-term economic goals such as boosting housing to

avoid technical recessions.

This is the first of my 3 part series on the fundamentals driving the Australian Housing Bubble. Part 2 is already written and auto-scheduled for posting in one week and explored 3 Myths of the Bubble. Part 3 will target our mortgage lenders and photoshop will show them no mercy. For now i'm going to keep this post quite simple.

This blog is about the big bad bond bubble, but of

course when shit hits the fan it is going to get messy in many other places. From the IMF to the UN everyone is warning Australia about its Housing Bubble, but the Aussie attitude is still "no worries, we've got mining, she'll be right." We are actually extremely vulnerable in the Australian Housing Market. Please click on the image below to get a bigger look at the chart.

Question: Is Australian Housing in a Bubble? YES

The blue line represent the Real Housing Prices in Australia since 1880. The red line represents the typical phases and trajectory of an asset bubble. Do you see any correlation?

1950's to 1980's: This bubble has been in the making for quite sometime, as lending standards allowed for easy credit to flow into the market for the second half of the last century. This debt accumulation has expanded exponentially despite typical financial cycles.

1990's: In the later half of the 90's as the tech bubble really took off, the media was giving massive amounts of attention to the ease of margin lending and the rapid rate of housing price increases. The media lived up to its image and allowed for the mania phase of this bubble to take off.

2000's: Australia shrugged off the tech bubble bursting and put even more faith into housing. Enthusiasm led to greed and greed led to delusion. Even after the GFC and US housing bubble we still turned our nose up to the rest of the world and took the Governments free housing grant money and kept buying at higher and higher prices.

2010's: Cracks start appearing on prices and are labelled a "soft-landing." This is announced as a temporary flattening of housing prices. The term "soft-landing" epitomises the Denial Phase of any bubble. This will only lead to a bull trap in 2013- early 2014 as stock market rallies make investors believe that there is now a "return to normal."

Predictions:

Towards the middle of 2014 you will see the Chinese Housing Bubble burst. This is now widely accepted as overdue, and mid-2014 is a conservative estimate on my part. This will lead to manageable financial turmoil and a temporary pull-back of industry in China. But they will need this correction as currently they have 64 million uninhabited dwellings. This temporary pullback will strain the Australian economy massively.

The US Federal Reserve is expanding its money base at the rate of $85 billion per month, what this means is when we do business with the USA we are being paid in their rapidity depreciating currency. But essentially we are being paid in their inflation, and the same goes for business with Japan. Australia is finding itself as canon fodder in these currency wars and will be forced to raise interest rates as we import inflation from abroad leading to higher domestic inflation.

The temporary recovery of housing prices in 2013-early 2014 will suddenly begin to collapse with all these factors and you will see the Aussie Housing Market begin free-fall collapse by the end of 2014, start of 2015.

The US Federal Reserve is expanding its money base at the rate of $85 billion per month, what this means is when we do business with the USA we are being paid in their rapidity depreciating currency. But essentially we are being paid in their inflation, and the same goes for business with Japan. Australia is finding itself as canon fodder in these currency wars and will be forced to raise interest rates as we import inflation from abroad leading to higher domestic inflation.

The temporary recovery of housing prices in 2013-early 2014 will suddenly begin to collapse with all these factors and you will see the Aussie Housing Market begin free-fall collapse by the end of 2014, start of 2015.

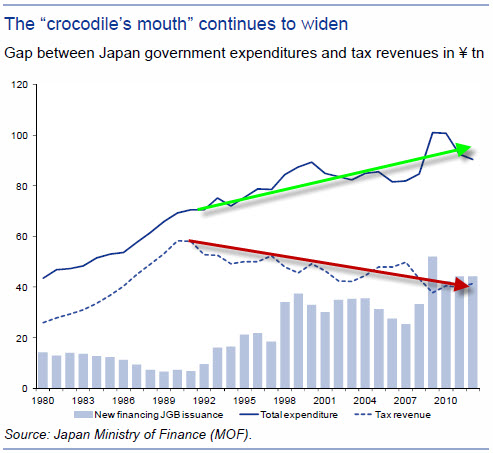

Japan's Debt Problem Visualized

There is a great video on the mathematical inevitability of Japan to reach default. With the announcement they will double their monetary base in the next 2 years they are certainly hoping to get inflation. It is a really disjointed way of creating inflation because what happens is they will achieve high inflation in food & energy first and this wont be counted in official statistics (as they are considered volatile prices). This will start to cripple the populations future savings and thus investment potential, but the Japanese are willing to sacrifice their own whilst trying to attract higher returns from foreign investors because at the moment the 1% yield on government bonds is not so attractive. They problem is that they are wayyyy to late in the debt game to inflate their yields. With one quadrillion yen of debt accumulated, I'm sorry to say there is no going back, and no going forward... the debt is just too big, and so they will be going sideways until investors pull-out. I predict this will be in the next 12 months.

Enjoy the video.

Wednesday, March 27, 2013

Bitcoin Explained: All you need to know about Bitcoin

I think This video sums up what I think about bitcoin, I was recently suspended on Twitter for telling @maxkeiser that I thought his Bitcoin Fantasy was equivalent to Ass Pennies. He rallied his supporters to report and suspend me! What a douche. Anyhow I got my account back and went on to explain 6 different ways Bitcoin could flashcrash overnight and 10 different ways Bitcoin is a Ponzi Scheme .. check out my twitter page, handle is @nickj4848. I guarantee you will enjoy following my twitter.

Thursday, March 21, 2013

Harpooning oneself in the foot: The Japanese Bond Market Bubble, by Ah0707

Since

the post-WW2 period Japan has had 3 financial bubbles, two of which that have

popped in dramatic style. In 1989, the Nikkei 225 Stock index had risen to a

peak of 38.957.44 points only to have collapsed to below 8,000 points by 2003.

Around this same period, the price of Japanese Real Estate had fallen faster

than an elephant after being kicked out of a plane, with prices falling by as

much as 99% in Tokyo’s financial district. The combination of these bubbles

popping had wiped out tens of trillions of dollars, or more than half the

world’s GDP to put it into context.

These two

bubble pops, however will pale in comparison to the next one coming: Japanese

Bonds. To set a bit of context, the Japanese government, in order to stimulate

the economy back in the early 90s, had effectively begun printing money

(issuing bonds) at such a frenetic pace (and has continued unabated for the

last two decades) that the amount of government bonds issued far out-stripped

the amount of tax revenue they receive from Japanese citizens. At the moment

Japan’s government gross debt sits at 240% of GDP (More fun if we start talking

though in terms of Yen, Quadrillions of it).

While even

getting to this mark does seem logically-defying for any rational thinking

human being, what made this possible up until now were three key factors: A

large pool of savings, low interest rates, and a postive trade surplus

(earnings from exports are greater than the costs of imports).

At face

level, the following statistics could put one’s mind at ease that there is no

crisis to really worry about: Japanese have $19 trillion dollars in savings and

90% of Japanese Government Bonds are held domestically, so say if China or the

US were to decide to dump their holdings in Japanese Government Bonds, it would

not lead to a collapse in the Japanese economy. In addition overnight cash

interest rates are around 0.1% per annum, which is the lowest rate amongst all

the major central banks in the world. The below link attests this:

All good? Not quite.

Let us start

with the savings rate: During the hey-days of the late 80s and early 90s, Japan

had a savings rate of around 15 to 25%. Today it is under 3%. The two main

causes are: a) declining asset prices (i.e. deflation), and b) an ageing

population. We have effectively touched on the asset price collapse over the

last two decades with the real estate and stock market bubbles, so we will

focus on the impact of the aging population. More than 23% of Japan’s

population are above the retirement age of 65 (compare that to 11.6% in 1989),

and as the chart clearly shows below, there is a direct correlation between the

decline in the working age population and the rate of economic growth (makes

sense - less able workers, less production…).

Apart from having

a lower proportion of the population in the workforce, pension funds and

insurance companies have had to start selling their Japanese Government Bond

(JGB) holdings in order to payout the retirement benefits that are owed. This

leads to the servicability of debt becoming more difficult (seriously who wants

to put their money into savings that would only get you next to nothing in

interest?). To ascertain the degree of desperation of those governing the

finances of the nation, one “remedial” solution proposed by the new (but don’t

know for how long) finance minster Aso Taro was to ask the elderly to “hurry up

and die” http://www.guardian.co.uk/world/2013/jan/22/elderly-hurry-up-die-japanese in order to reduce the cost of social welfare (18% of national income

currently, 27% by 2025) – what is the phone

number to The Hague, please?

Anyway moving

from that slightly morbid blot now is a good time to touch on interest rates, I

mean what interest rates? For about 17 or so years, the overnight cash rate in

Japan has been set by the Bank of Japan (BoJ) to under 1% per annum in order to

help revitalise the economy (see chart below).This has not quite worked out

(check out chart previously).

Now the

latest Prime Minster Shinzo Abe has promised to combat the deflation of asset

prices in Japan by proposing a 2% inflation target. This would imply making

assets, including Japanese Government Bonds more attractive to purchase. Now we

have touched on the fact that the savings rate in Japan is now under 3%, domestic

purchases would have a band-aid effect, so it would be wise to increase sales

to foreign investors, but again with a declining Yen and next to nothing

interest rates, what can make one more interested in purchasing bonds? One

solution is to increase the yield of return on Japanese Governement Bonds, but

this would imply raising interest rates.

There is a

fundamental problem to this however: Even at these low levels of interest,

25-30% of Japanese tax revenue is spent on servicing only the interest payments

for the bonds. It has been calculated that if interest rates go up to as much

as 2.5%-3.5% per annum, the tax revenue generated would not be enough to cover

the interest payments. At the moment the Japanese tax rate is 5%, with plans to

increase it to 10% by 2015, but even if all Japanese held assets were put to

service the debt issued by the Japanese government and taxes were raised to

100%, it has been forecasted that it would be enough to only service the debt

for another 12 years. Things look terminal at best.

The last

major point I want to look at is Japan’s trade surplus. Before the 2011

Earthquake/Fukushima disaster, Japan had maintained a positive trade balance

due to high volume of exports, as well as low dependency to meet the energy

requirements of the nation due to the development of nuclear reac tors.

Post

Fukushima, however, nuclear reactors were shut down leading to significnat

increases in energy imports, making Japan a net importer as oppose to a net

exporter (see chart below).

Combine that

with a weaker yen to boost exports, increased stimulus to revitalize

infrastructure (20 trillion yen promised by Shinzo Abe), falling exports to

China (it’s largest export partner, and territorial disputes brewing again) and

a downbeat global economy, it Is expected that the deficit will get much wider.

So what is it

that needs to be solved in Japan? Increase economic growth and increase the

value of asset prices. What can be done? Government go beserk, print more

money/issue more JGB at super-low interest rates and devalue Yen to increase

exports. That has been the current policy to date, and clearly has not worked..

So what about stopping the money printing, raise interest rates and increase

the value of the Yen? – As we have seen it is a quick step to sovereign

default. How about re-starting the nuclear reactors? – Not sure if one can

stomach 3-eyed fish. How about addressing xenephobic immigration policies or

increasing incentives to have larger families to increase the proportion of the

working age population? – Wishful thinking, but may be too late to implement as

it is.

If we put the

implications in a global context, consider that Japan is the third largest

economy in the world and holds $4 trillion US dollars in foreign assets. Now

mix with that the crisis in the Eurozone and Helicopter Ben Bernanke continuing

to go wild in the US with the never-ending “quantitative-easing” money printing,

we would most likely see a crisis in the Global Financial Markets unprecedented

in anyones’ time sooner rather than later.

Ah0707 - “Guns and Food (Gold and Silver too)”

Subscribe to:

Posts (Atom)